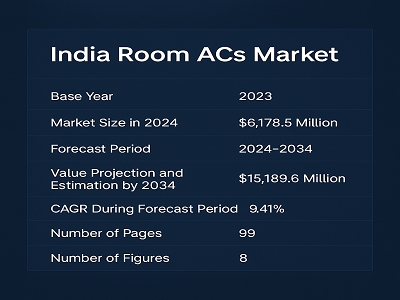

The India Room Air Conditioners market is set for strong expansion, with industry projections estimating a rise from $6,178.5 million in 2024 to $15,189.6 million by 2034, at a compound annual growth rate (CAGR) of 9.41%. This growth is driven by a surge in consumer demand, technological advancements, rising urbanization, and increasing emphasis on energy-efficient cooling solutions.

Rising Temperatures and Lifestyle Upgrades Fuel Demand

India has been experiencing increasingly severe summer temperatures and prolonged heatwaves, leading to a sharp rise in the demand for personal cooling systems. As incomes rise and living standards improve, consumers are prioritizing comfort, especially in Tier-I and Tier-II cities. Room ACs are no longer seen as luxury appliances but have become essential home and office utilities.

The affordability of EMI-based purchases, availability of compact inverter AC models, and expansion of organized retail and e-commerce channels have further fueled this demand, particularly among the younger demographic.

Inverter and Smart ACs Lead Technological Transformation

The market is undergoing a major shift with the adoption of inverter technology and smart, IoT-enabled air conditioners. Inverter ACs now dominate new installations, due to their energy-saving capabilities and longer life cycles. Brands are increasingly offering models that integrate with home automation platforms such as Alexa and Google Home, appealing to the tech-savvy urban audience.

In addition, manufacturers are focusing on green refrigerants (R-32 and R-290) to meet sustainability goals and adhere to India’s Cooling Action Plan (ICAP) and international climate commitments.

Segment Insights: Split ACs Continue to Dominate

-

Split ACs account for more than 70% of total room AC sales, thanks to their efficiency, aesthetics, and adaptability to varied room sizes.

-

Window ACs maintain a loyal customer base in smaller cities due to cost-efficiency and ease of installation.

-

The 1–1.5 Ton capacity segment is the most popular, meeting the needs of average-sized Indian homes.

-

5-Star rated ACs are gaining traction, particularly in metro cities, as consumers become more energy-conscious and government promotes energy-efficient appliances through star labeling programs.

Request a Sample for India Room ACs Market- A Global and Regional Analysis 2024-2034

Market Opportunities: Penetration in Semi-Urban and Rural Regions

Despite the growing sales in urban India, room AC penetration at the national level remains below 10%, indicating vast untapped potential. With rising electrification, improved rural infrastructure, and schemes promoting energy-efficient appliances, Tier-III towns and rural markets present strong growth opportunities for RAC manufacturers.

Leading brands are actively expanding their dealer networks, service footprints, and offering region-specific marketing campaigns to drive adoption in these under-penetrated zones.

Key Players and Competitive Landscape

India’s room AC industry is highly competitive, with the presence of both multinational and domestic brands. Prominent players include:

-

Voltas – Continues to lead in overall market share, especially in the budget and mid-range segments.

-

LG, Samsung, Panasonic – Focus on premium and smart AC models with strong after-sales service.

-

Blue Star, Daikin, Lloyd – Known for reliability, energy-efficiency, and a growing retail presence.

-

Godrej, Whirlpool, Haier – Expanding footprint with affordable, eco-conscious offerings.

-

OEMs like Amber Enterprises – Play a crucial role in enabling mass manufacturing and product diversification under the “Make in India” initiative.

India’s Production Linked Incentive (PLI) scheme and phased manufacturing program (PMP) have further strengthened local manufacturing, encouraging global players to set up or expand production bases in the country.

Challenges: Energy Load and Affordability

While growth prospects remain strong, the RAC market faces challenges in terms of power consumption and upfront product costs:

-

Room ACs account for a significant share of peak residential electricity consumption during summer, prompting energy regulators to encourage more sustainable usage patterns, such as default temperature settings at 24°C.

-

Initial purchase costs, especially for inverter and smart AC models, remain high for lower-income segments. However, financing options, subscription-based models, and seasonal promotional offers are helping to narrow this affordability gap.

Future Outlook: Cooling for All by 2034

With strong government backing, rising environmental awareness, and increasing consumer aspiration, India’s RAC market is projected to evolve rapidly over the next decade. Key trends expected to shape the market include:

-

Accelerated adoption of 5-star inverter ACs driven by both consumer awareness and regulatory mandates.

-

Expansion of smart and connected AC ecosystems, driven by AI, voice integration, and remote diagnostics.

-

Growing focus on green cooling through natural refrigerants and carbon-neutral manufacturing processes.

-

Increased market consolidation and innovation in business models, such as AC rentals and solar-powered units.

Conclusion

The India Room ACs market stands at the threshold of exponential growth. With the market expected to more than double in value by 2034, opportunities abound for manufacturers, distributors, and investors alike. The race is on to deliver efficient, smart, and affordable cooling to India’s fast-evolving residential and commercial segments.

About BIS Research

BIS Research, recognized as a top market research company, specializes in market research reports and advisory services focused on deep technology and emerging trends that are poised to disrupt key industrial markets. Annually, we publish over 200 market intelligence reports across various deep technology verticals.

Our insights support leaders across industries in making informed decisions based on deep market analysis, competitive intelligence, and strategic forecasting. We work closely with innovation-driven stakeholders across data centers, energy & Power, healthcare, and more. We help businesses stay ahead with in-depth reports, custom research, and go-to-market strategies tailored to your goals.

Media Contact

Company Name: BIS Research

Contact Person: Bhavya Banga

Email: Send Email

Phone: +1-510-404-8135

Address:39111 PASEO PADRE PKWY STE 313, FREMONT CA 94538

Country: United States

Website: https://bisresearch.com/industry-report/india-room-acs-market.html