Let’s dig into the relative performance of Mattel (NASDAQ:MAT) and its peers as we unravel the now-completed Q1 toys and electronics earnings season.

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

The 4 toys and electronics stocks we track reported an exceptional Q1. As a group, revenues beat analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

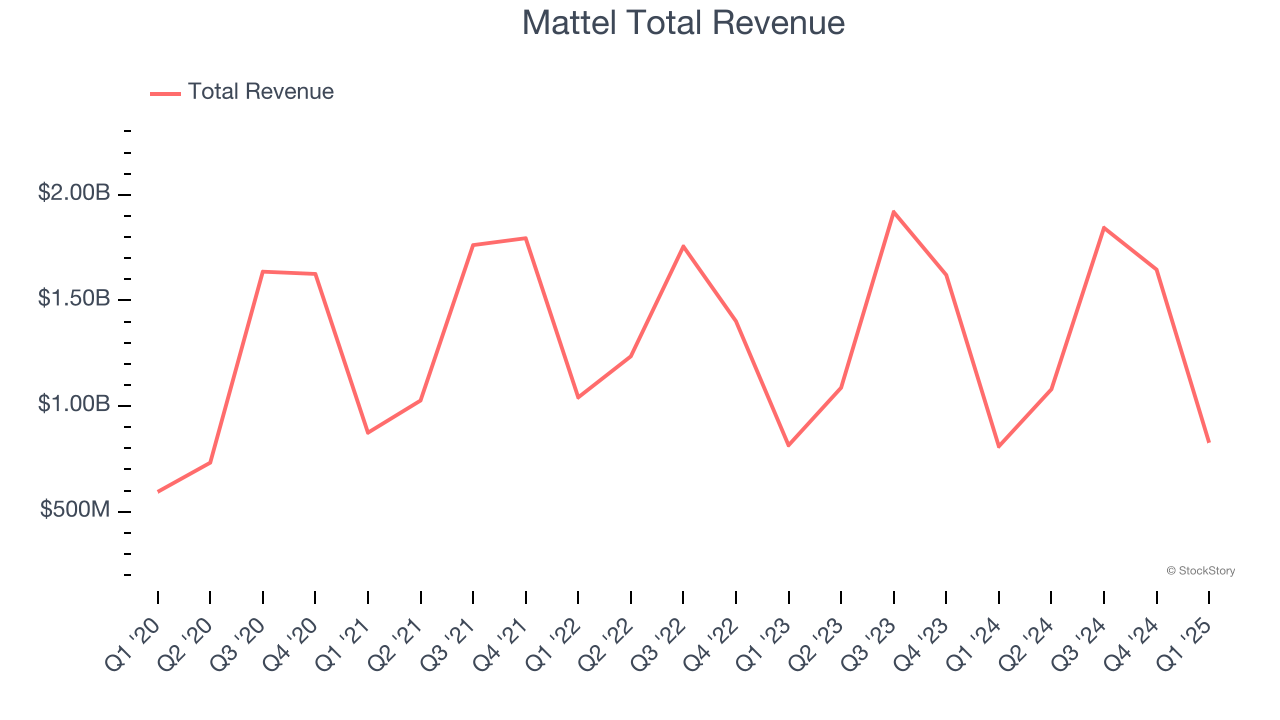

Mattel (NASDAQ:MAT)

Known for the creation of iconic toys such as Barbie and Hotwheels, Mattel (NASDAQ:MAT) is a global children's entertainment company specializing in the design and production of consumer products.

Mattel reported revenues of $826.6 million, up 2.1% year on year. This print exceeded analysts’ expectations by 4.4%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Ynon Kreiz, Chairman and CEO of Mattel, said: “This was a strong quarter for Mattel, with positive performance and continued operational excellence. Our brands are thriving, our products and experiences stand out in the marketplace, and our balance sheet gives us resilience and flexibility to execute our strategy. As we navigate the current period of macro-economic volatility, we are adapting with speed, agility, and discipline. We expect not only to manage through this period but strengthen our competitive position.”

The stock is up 15.8% since reporting and currently trades at $18.73.

Is now the time to buy Mattel? Access our full analysis of the earnings results here, it’s free.

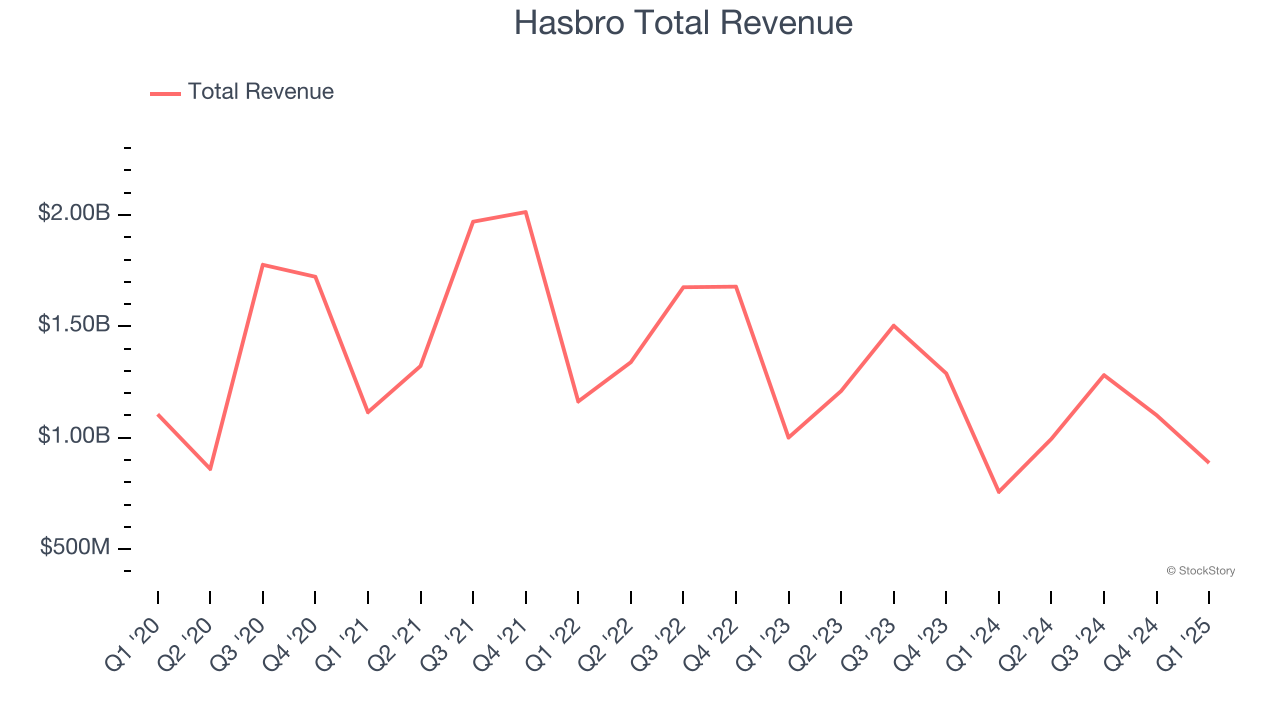

Best Q1: Hasbro (NASDAQ:HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Hasbro reported revenues of $887.1 million, up 17.1% year on year, outperforming analysts’ expectations by 14.8%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Hasbro scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 24.1% since reporting. It currently trades at $65.32.

Is now the time to buy Hasbro? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Bark (NYSE:BARK)

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

Bark reported revenues of $115.4 million, down 5% year on year, falling short of analysts’ expectations by 9.9%. It was a mixed quarter as it posted a solid beat of analysts’ EPS estimates but a significant miss of analysts’ adjusted operating income estimates.

Bark delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 26.9% since the results and currently trades at $0.99.

Read our full analysis of Bark’s results here.

Funko (NASDAQ:FNKO)

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko reported revenues of $190.7 million, down 11.6% year on year. This number was in line with analysts’ expectations. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

Funko had the slowest revenue growth among its peers. The stock is up 5.3% since reporting and currently trades at $4.41.

Read our full, actionable report on Funko here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.