Outdoor lifestyle and equipment company Clarus (NASDAQ:CLAR) beat Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 2.2% year on year to $55.25 million. Its non-GAAP loss of $0.03 per share was $0.02 below analysts’ consensus estimates.

Is now the time to buy Clarus? Find out by accessing our full research report, it’s free.

Clarus (CLAR) Q2 CY2025 Highlights:

- Revenue: $55.25 million vs analyst estimates of $53.38 million (2.2% year-on-year decline, 3.5% beat)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.01 ($0.02 miss)

- Adjusted EBITDA: -$2.10 million vs analyst estimates of -$658,600 (-3.8% margin, significant miss)

- Operating Margin: -19.7%, down from -14.4% in the same quarter last year

- Market Capitalization: $138.2 million

“Despite continued headwinds across the global outdoor market, we remain focused on operational execution and disciplined investment aligned with our strategic roadmap,” said Warren Kanders, Clarus’ Executive Chairman.

Company Overview

Initially a financial services business, Clarus (NASDAQ:CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

Revenue Growth

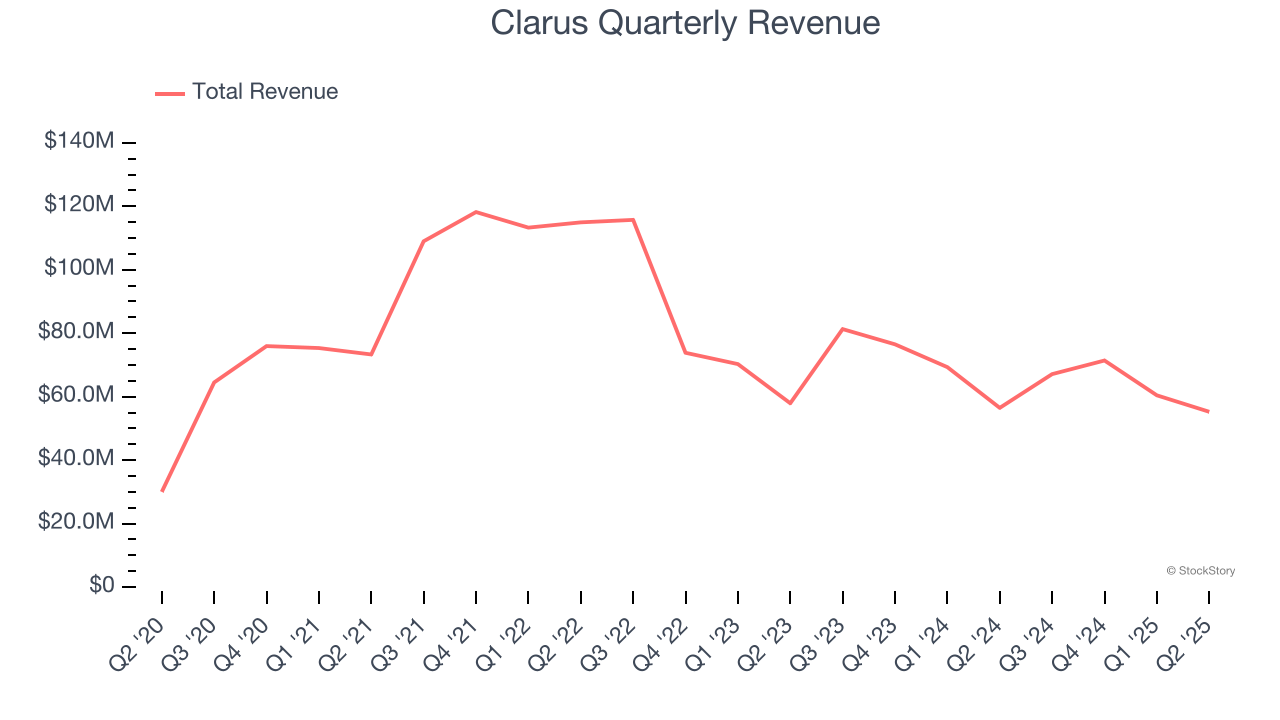

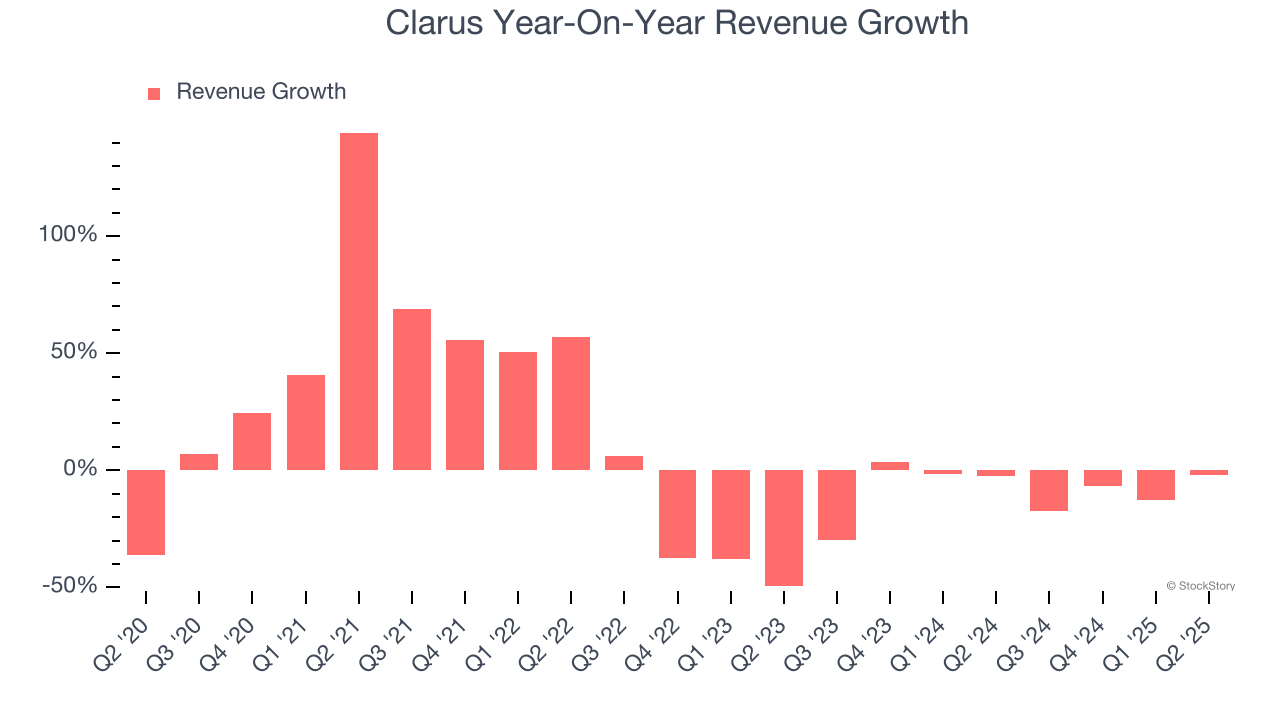

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Clarus’s 4.4% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Clarus’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.6% annually.

This quarter, Clarus’s revenue fell by 2.2% year on year to $55.25 million but beat Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

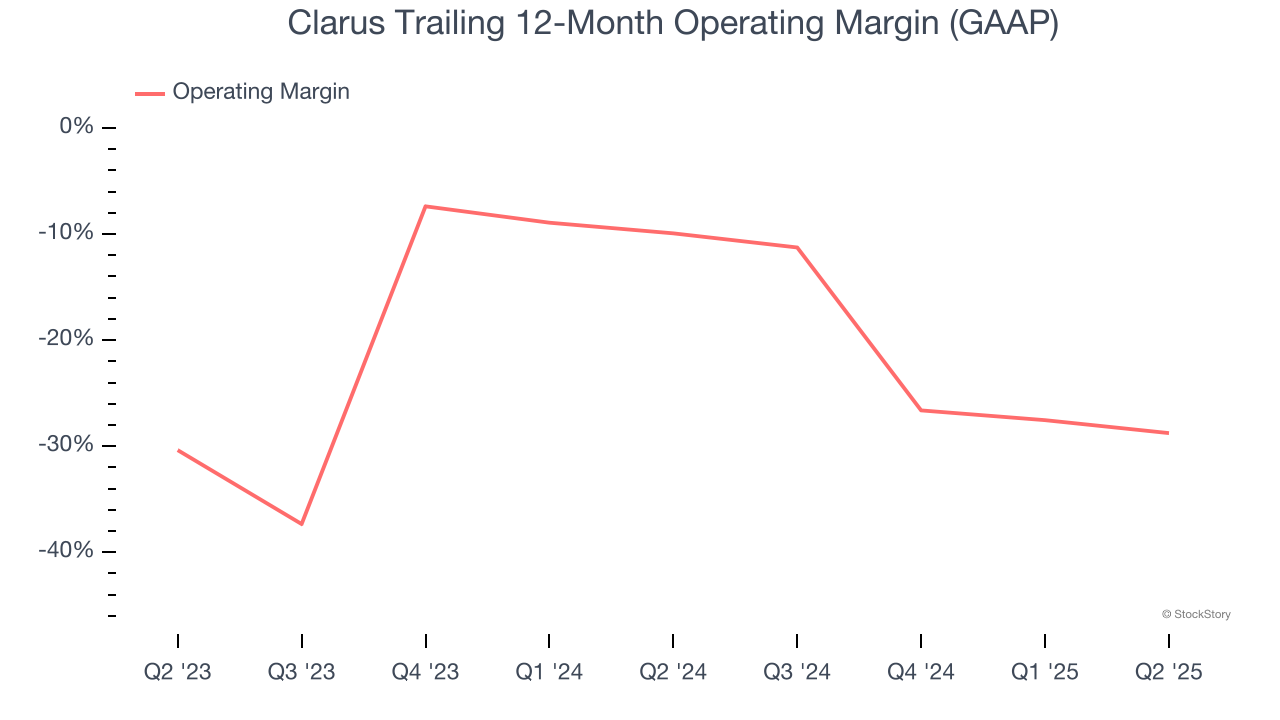

Operating Margin

Clarus’s operating margin has shrunk over the last 12 months and averaged negative 18.8% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

Clarus’s operating margin was negative 19.7% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

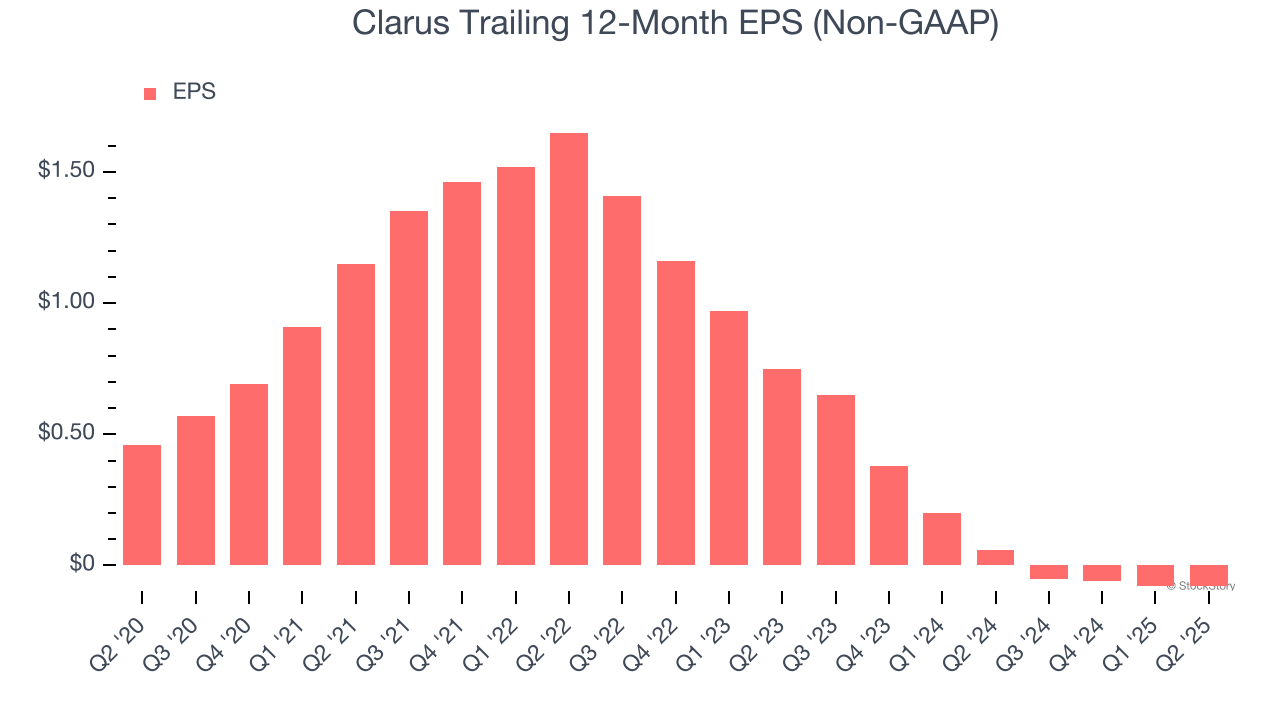

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Clarus, its EPS declined by 16.8% annually over the last five years while its revenue grew by 4.4%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q2, Clarus reported adjusted EPS at negative $0.03, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Clarus’s full-year EPS of negative $0.08 will reach break even.

Key Takeaways from Clarus’s Q2 Results

It was good to see Clarus beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA and EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $3.57 immediately following the results.

Clarus’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.