Outerwear manufacturer Columbia Sportswear (NASDAQ:COLM) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 6.1% year on year to $605.2 million. On the other hand, next quarter’s revenue guidance of $913 million was less impressive, coming in 2.2% below analysts’ estimates. Its GAAP loss of $0.19 per share was 20% above analysts’ consensus estimates.

Is now the time to buy Columbia Sportswear? Find out by accessing our full research report, it’s free.

Columbia Sportswear (COLM) Q2 CY2025 Highlights:

- Revenue: $605.2 million vs analyst estimates of $588.7 million (6.1% year-on-year growth, 2.8% beat)

- EPS (GAAP): -$0.19 vs analyst estimates of -$0.24 (20% beat)

- Adjusted EBITDA: -$35.55 million vs analyst estimates of -$900,000 (-5.9% margin, significant miss)

- Revenue Guidance for the full year is $3.37 billion at the midpoint, below analyst estimates of $3.40 billion

- EPS (GAAP) guidance for Q3 CY2025 is $1.10 at the midpoint, missing analyst estimates by 19.2%

- Operating Margin: -3.9%, in line with the same quarter last year

- Free Cash Flow was -$15.28 million compared to -$10.87 million in the same quarter last year

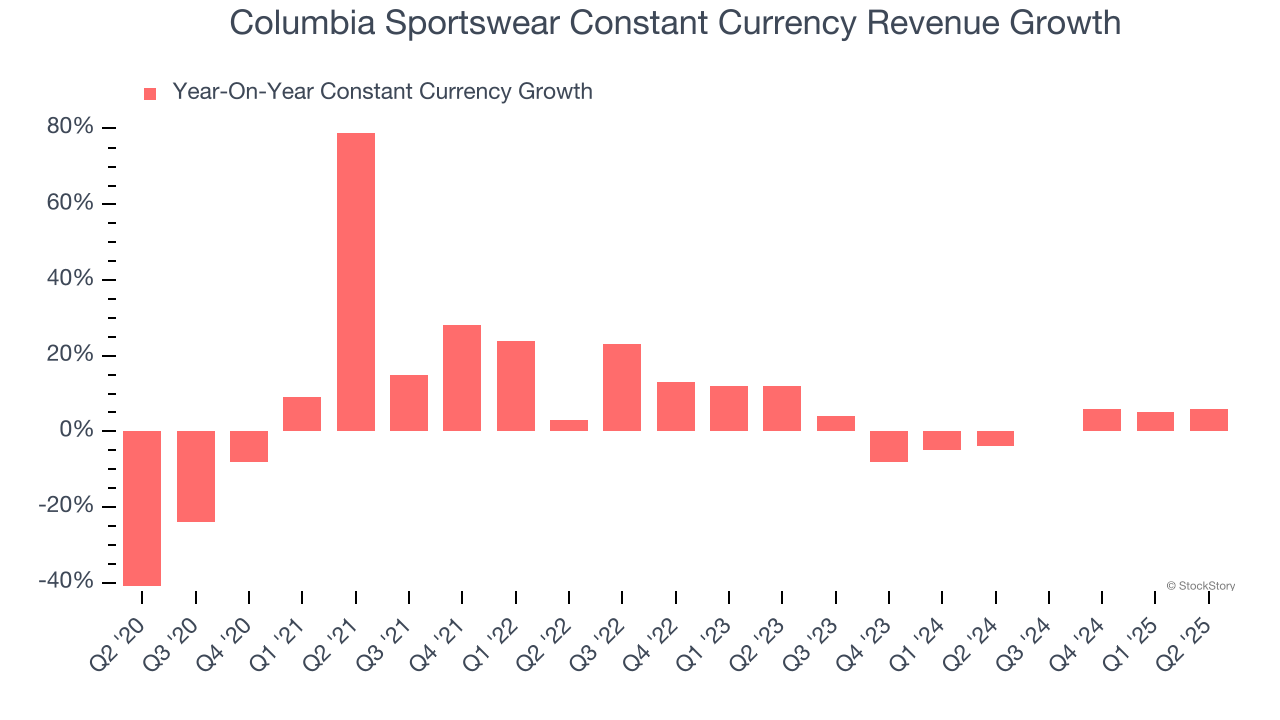

- Constant Currency Revenue rose 6% year on year (-4% in the same quarter last year)

- Market Capitalization: $3.20 billion

Chairman, President and Chief Executive Officer Tim Boyle commented, “Second quarter and first half financial results reflect sustained momentum in our international markets. While business trends in our U.S. business remain soft, we continue to take steps to re-energize the Columbia brand through our ACCELERATE growth strategy. In the coming days, we will launch one of the most impactful components of this strategy, our new highly differentiated Columbia brand voice and marketing campaign.

Company Overview

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ:COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Revenue Growth

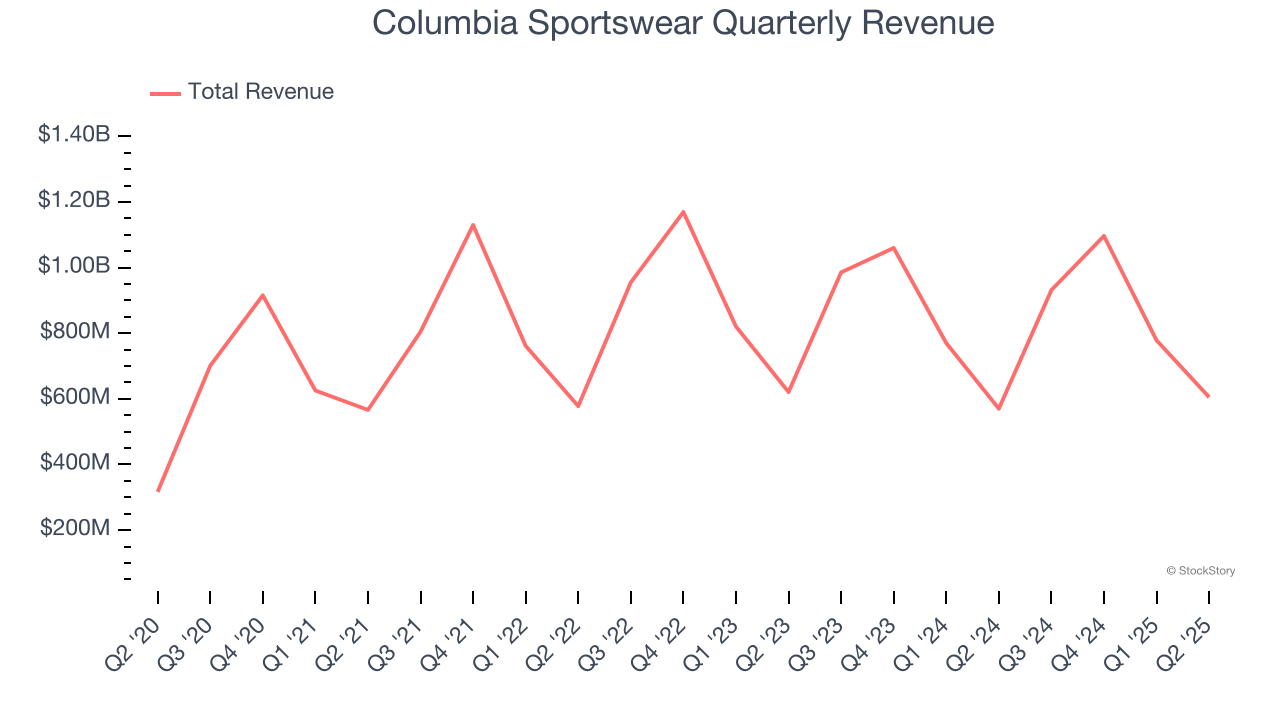

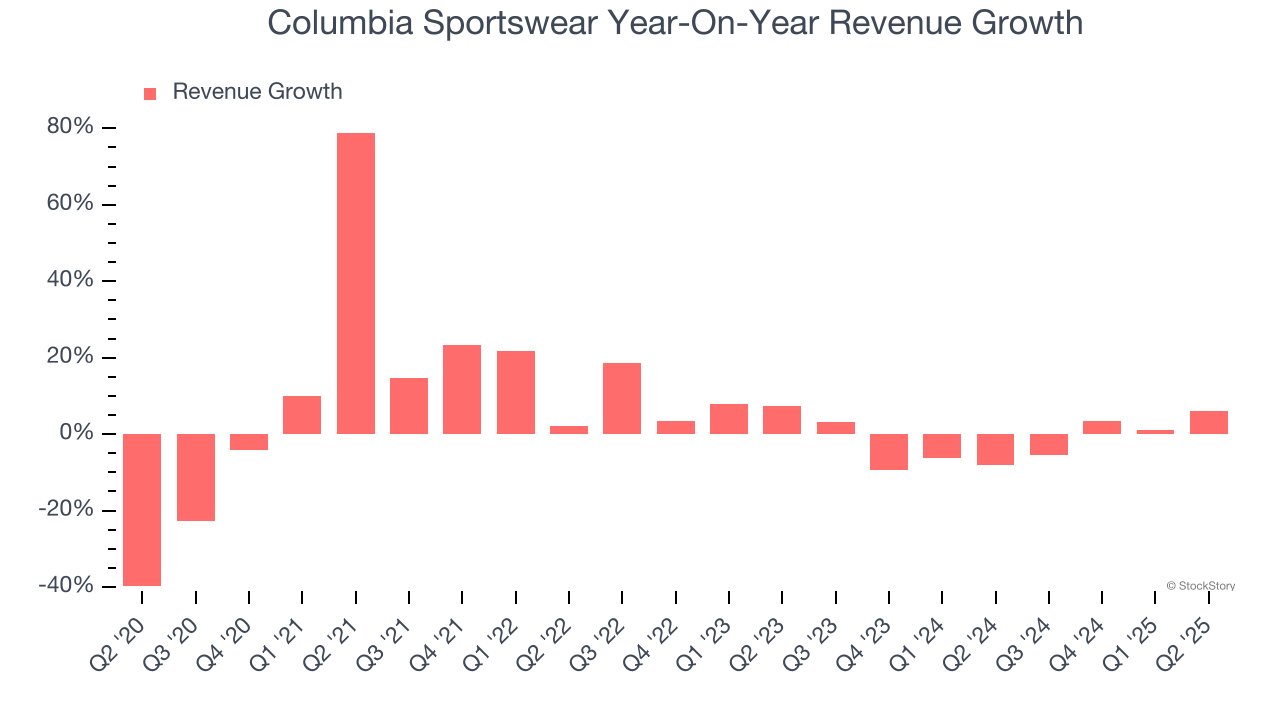

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Columbia Sportswear’s sales grew at a sluggish 4.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Columbia Sportswear’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.2% annually.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales were flat. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Columbia Sportswear.

This quarter, Columbia Sportswear reported year-on-year revenue growth of 6.1%, and its $605.2 million of revenue exceeded Wall Street’s estimates by 2.8%. Company management is currently guiding for a 2% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

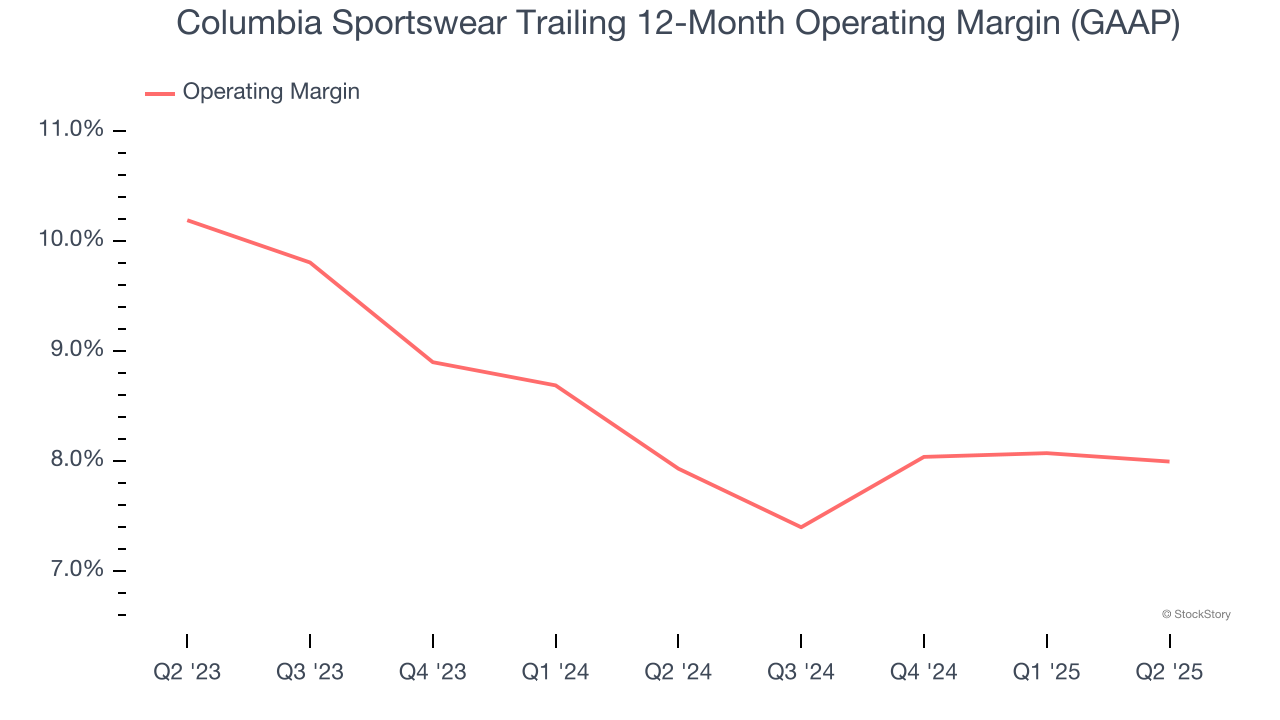

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Columbia Sportswear’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 8% over the last two years. This profitability was paltry for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Columbia Sportswear generated an operating margin profit margin of negative 3.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

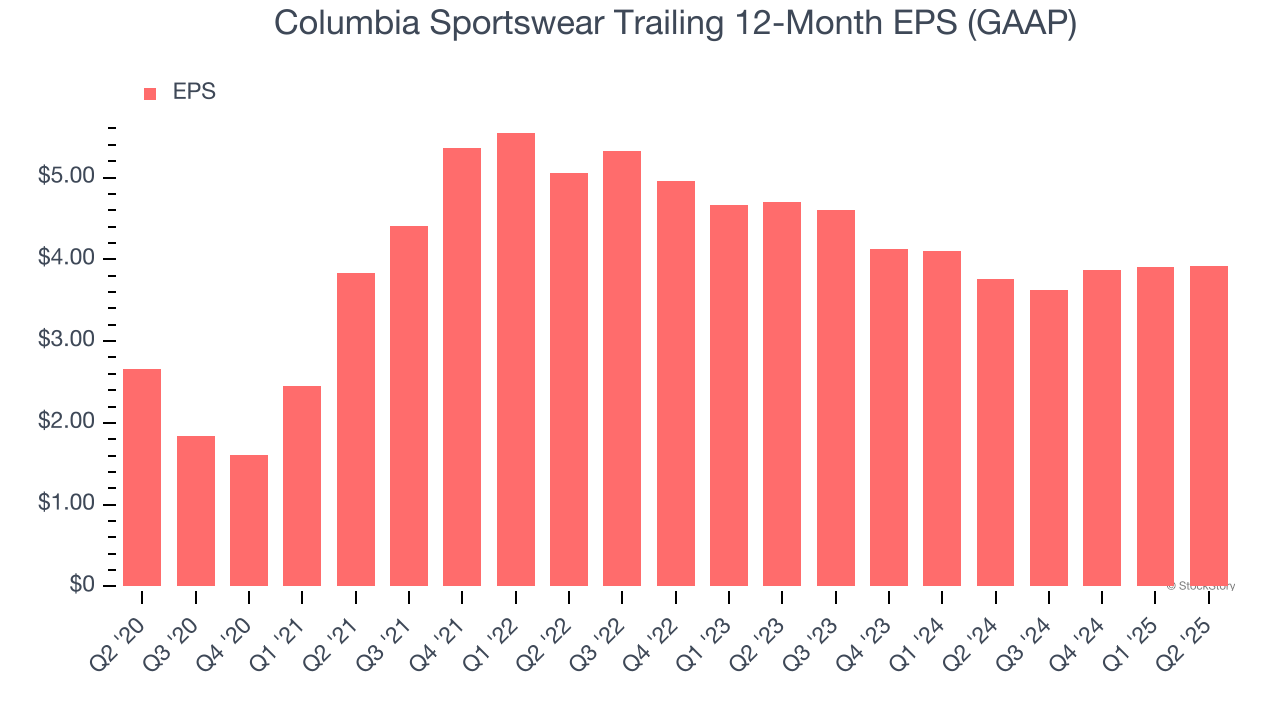

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Columbia Sportswear’s EPS grew at an unimpressive 8.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4.4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Columbia Sportswear reported EPS at negative $0.19, up from negative $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Columbia Sportswear’s full-year EPS of $3.92 to shrink by 18.7%.

Key Takeaways from Columbia Sportswear’s Q2 Results

We enjoyed seeing Columbia Sportswear beat analysts’ constant currency revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 9.1% to $51.40 immediately following the results.

The latest quarter from Columbia Sportswear’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.