As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the apparel retailer industry, including Tilly's (NYSE:TLYS) and its peers.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

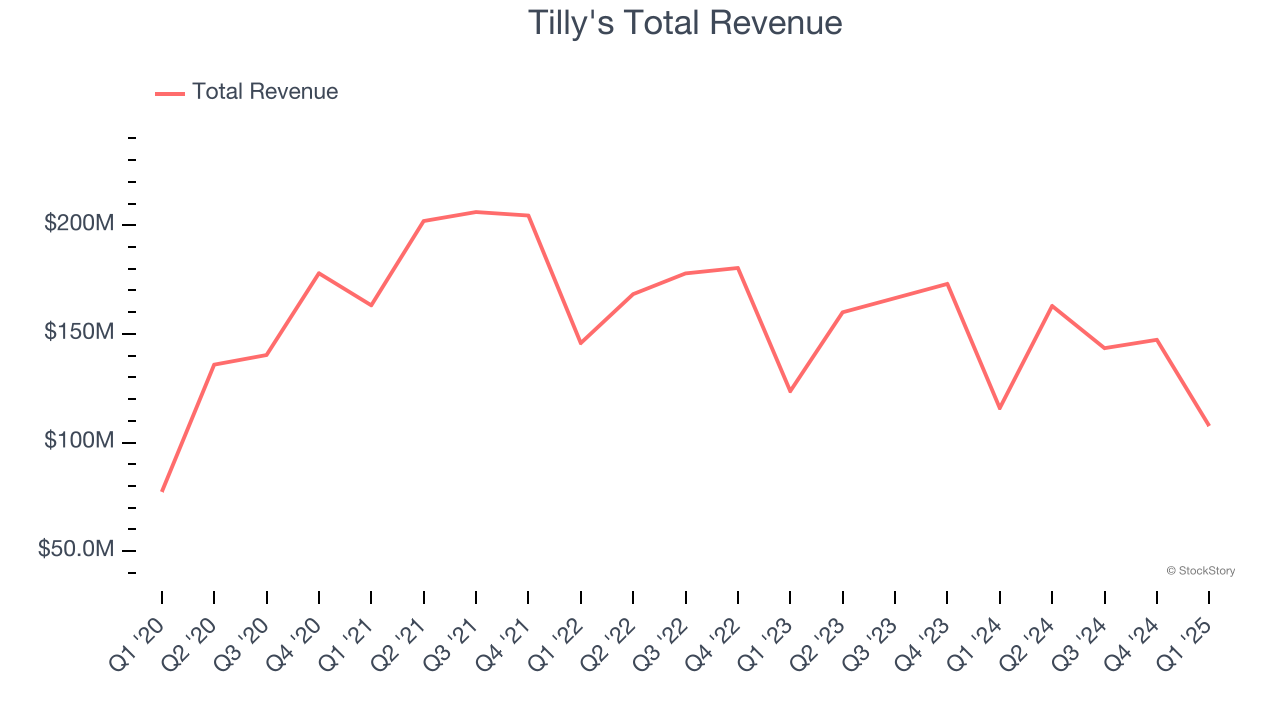

Tilly's (NYSE:TLYS)

With an emphasis on skate and surf culture, Tilly’s (NYSE:TLYS) is a specialty retailer that sells clothing, footwear, and accessories geared towards fashion-forward teens and young adults.

Tilly's reported revenues of $107.6 million, down 7.1% year on year. This print fell short of analysts’ expectations by 0.5%. Overall, it was a slower quarter for the company with a significant miss of analysts’ EBITDA estimates and EPS guidance for next quarter missing analysts’ expectations significantly.

"Our fiscal 2025 first quarter comparable net sales, while a decrease compared to last year's first quarter, were a sequential improvement in trend compared to the fourth quarter of fiscal 2024. Fiscal May, to start the second quarter, produced further sequential trend improvement relative to the first quarter," commented Hezy Shaked, President and Chief Executive Officer.

Tilly's delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 27.1% since reporting and currently trades at $1.69.

Read our full report on Tilly's here, it’s free.

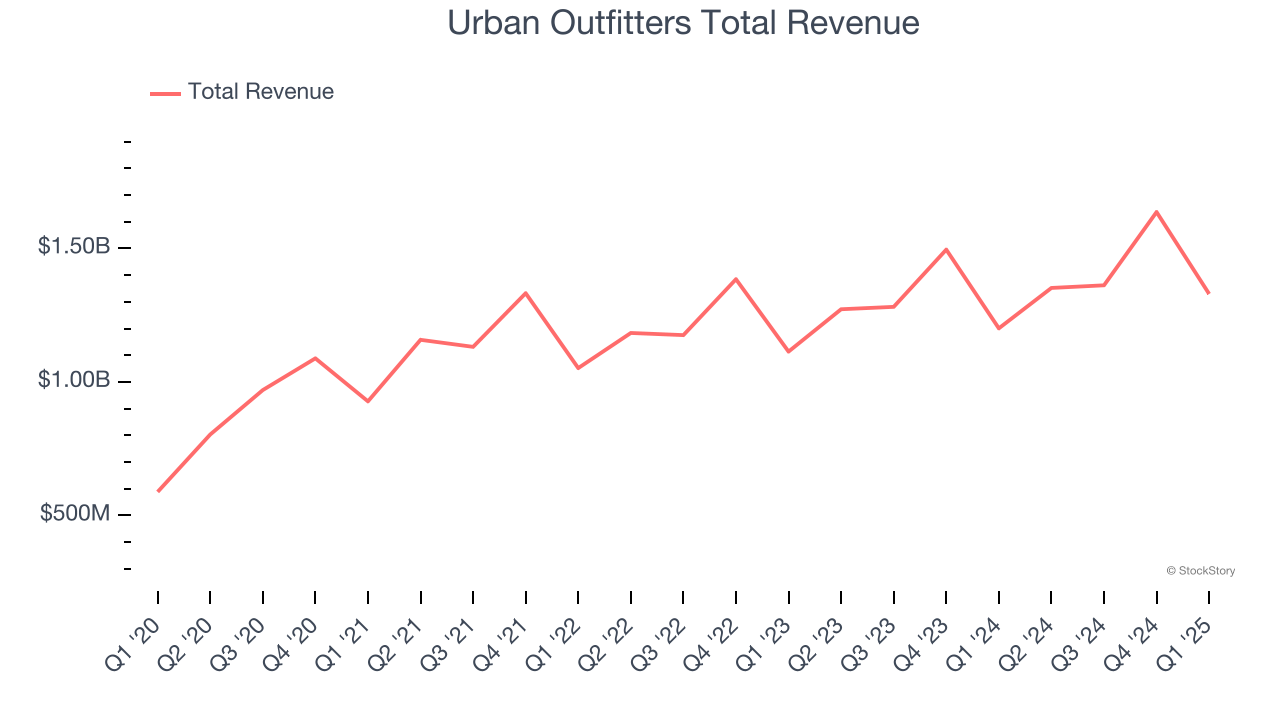

Best Q1: Urban Outfitters (NASDAQ:URBN)

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ:URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

Urban Outfitters reported revenues of $1.33 billion, up 10.7% year on year, outperforming analysts’ expectations by 2.5%. The business had a stunning quarter with a solid beat of analysts’ EPS and EBITDA estimates.

Urban Outfitters achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 33% since reporting. It currently trades at $79.31.

Is now the time to buy Urban Outfitters? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: American Eagle (NYSE:AEO)

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

American Eagle reported revenues of $1.09 billion, down 4.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 19.8% since the results and currently trades at $13.39.

Read our full analysis of American Eagle’s results here.

Victoria's Secret (NYSE:VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE:VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $1.35 billion, flat year on year. This print beat analysts’ expectations by 0.8%. Zooming out, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ gross margin estimates.

Victoria's Secret achieved the highest full-year guidance raise among its peers. The stock is down 7.1% since reporting and currently trades at $20.62.

Read our full, actionable report on Victoria's Secret here, it’s free.

Gap (NYSE:GAP)

Operating under the Gap, Old Navy, Banana Republic, and Athleta brands, Gap (NYSE:GAP) is an apparel and accessories retailer selling casual clothing to men, women, and children.

Gap reported revenues of $3.46 billion, up 2.2% year on year. This number topped analysts’ expectations by 1.3%. It was a very strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

The stock is down 30.1% since reporting and currently trades at $19.54.

Read our full, actionable report on Gap here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.